Videos de Sexo > Bookkeeping > The Double Declining Balance Depreciation Method

Descricao do video:

Contents:

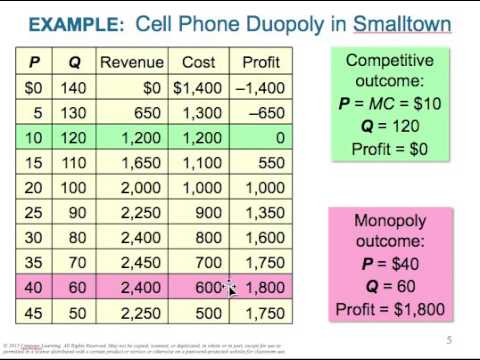

Use this calculator to calculate and print an accelerated depreciation schedule of an asset for a specified period. A depreciation factor of 200% of straight line depreciation, or 2, is most commonly called the Double Declining Balance Method. Use this calculator, for example, for depreciation rates entered as 1.5 for 150%, 1.75 for 175%, 2 for 200%, 3 for 300%, etc. The double declining balance depreciation method is an approach to accounting that involves depreciating certain assets at twice the rate outlined under straight-line depreciation. This results in depreciation being the highest in the first year of ownership and declining over time.

- The double declining balance depreciation rate is twice what straight line depreciation is.

- Alternatively, think about reaching out to a reputable accountant for assistance calculating your business tax deductions.

- Therefore, it represents the reduction in the value of a fixed asset over the period due to usage.

- In essence, the double-declining balance method uses a double charge compared to the declining balance method.

- This method is used only when calculating depreciation for equipment or machinery, the useful life of which is based on production capacity rather than a number of years.

- Not all assets are purchased conveniently at the beginning of the accounting year, which can make the calculation of depreciation more complicated.

You calculate 200% of the straight-line depreciation, or a factor of 2, and multiply that value by the book value at the beginning of the period to find the depreciation expense for that period. Accumulated DepreciationThe accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. It is a contra-account, the difference between the asset’s purchase price and its carrying value on the balance sheet. First, the IRS does not permit the use of double declining balance depreciation for tax purposes, but it does allow MACRS, which is similar to DDB. With your second year of depreciation totaling $6,720, that leaves a book value of $10,080, which will be used when calculating your third year of depreciation. The following table illustrates double declining depreciation totals for the truck.

What are the Benefits of Factoring Your Account Receivable?

The depreciation expense will be lower in the later years compared to the straight-line depreciation method. Depreciation ExpenseDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized.

Eric Gerard Ruiz is an accounting and bookkeeping expert for Fit Small Business. He completed a Bachelor of Science degree in Accountancy at Silliman University in Dumaguete City, Philippines. And CPA registered in the Philippines Before joining FSB, Eric has worked as a freelance content writer with various digital marketing agencies in Australia, the United States, and the Philippines. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content.

Double Declining Balance Depreciation Method

This method requires you to assign all depreciated assets to a specific asset category. An updated table is available in Publication 946, How to Depreciate Property. When using MACRS, you can use either straight-line or double-declining method of depreciation. Straight line depreciation is the easiest depreciation method to use.

That double declining balance method is to accelerate decline type. Using that method to Book Value at the beginning of each period is multiplied by adenine fixed Depreciation Evaluate which is 200% of the straight row depreciation rate, or a factor regarding 2. Up calculate depreciation based on a different factor use our Declining Balance Calculator.

The following section explains the step-by-step process for calculating the depreciation expense in the first year, mid-years, and the asset’s final year. Use this calculator to calculate the accelerated depreciation by Double Declining Balance Method or 200% depreciation. For other factors besides double use the Declining Balance Method Depreciation Calculator. FitBuilders estimates that the residual or salvage value at the end of the fixed asset’s life is $1,250.

The Double Declining Depreciation Method: A Beginner’s Guide – The Motley Fool

The Double Declining Depreciation Method: A Beginner’s Guide.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

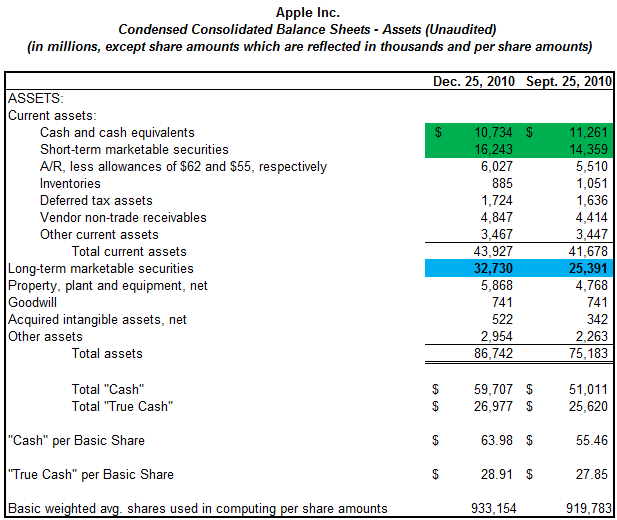

Any silly mistake would lead to an inaccurate charge of depreciation expense. Deferring TaxDeferred Tax is the effect that occurs in a firm as a result of timing differences between the date when taxes are actually paid to tax authorities by the company and the date when such tax is accrued. Simply put, it is the difference in taxes that arises when taxes due in one of the accounting period are either not paid or overpaid. The company is less profitable in the early years than in later years; thus, it will be difficult to measure its true operational profitability. The amount earned after selling the asset will be shown as the cash inflow in the cash flow statement, and the same will be entered in the cash and cash equivalents line of the balance sheet. Cash And Cash EquivalentsCash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation.

Let’s examine the steps that need to be taken to calculate this form of accelerated depreciation. Depreciation can be one of the more confusing aspects of accounting. The purpose of depreciation is to allocate the cost of a fixed or tangible asset over its useful life. Once the asset is valued on the company’s books at its salvage value, it is considered fully depreciated and cannot be depreciated any further.

By applying the DDB depreciation method, you can depreciate these assets faster, capturing tax benefits more quickly and reducing your tax liability in the first few years after purchasing them. The DDB depreciation method is easy to implement and track in most accounting software. Under the declining balance method, depreciation is charged on the book value of the asset and the amount of depreciation decreases every year. The depreciation process for an asset begins when a company puts an asset into use. However, it must meet the accounting definition set for the term asset.

Partial Year Depreciation

Companies prefer a double-declining approach for assets that is expected to be obsolete more quickly. But the depreciation expense will be charge for which accelerated rate, total depreciation throughout aforementioned life of the key would remain the same. Some companies use accelerated depreciation methods to defer their tax obligations into future years. It was first enacted and authorized under the Internal Revenue Code in 1954, and it was a major change from existing policy. The final step before our depreciation schedule under the double declining balance method is complete is to subtract our ending balance from the beginning balance to determine the final period depreciation expense. In using the declining balance method, a company reports larger depreciation expenses during the earlier years of an asset’s useful life.

The Double Declining Balance Depreciation Method … – Business News Daily

The Double Declining Balance Depreciation Method ….

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

A vehicle is a perfect example of an asset that loses value quickly in the first years of ownership. Unlike straight line depreciation, which stays consistent throughout the useful life of the asset, double declining balance depreciation is high the first year, and decreases each subsequent year. While some accounting software applications have fixed asset and depreciation management capability, you’ll likely have to manually record a depreciation journal entry into your software application. With our straight-line depreciation rate calculated, our next step is to simply multiply that straight-line depreciation rate by 2x to determine the double declining depreciation rate. The DDB method records larger depreciation expenses during the earlier years of an asset’s useful life, and smaller ones in later years.

DDB depreciation formula

Based on the above calculation, this opening value will be $80,000 ($100,000 cost – $20,000 depreciation). Therefore, the double-declining balance method depreciation for the second year will be as follows. Fixed assets include resources that companies use to generate economic benefits in the long run. For example, a company’s fixed assets may contain land, building, vehicles, computers, etc. Instructions Assume that the equipment was depreciated under the double-declining-balance method.

Double declining depreciation is a good method to use when you expect the asset to lose its value earlier rather than later. Compared with the straight-line method, it doubles the amount of depreciation expense you can take in the first year. Calculating depreciation is the first step in managing depreciation expense. But you also need to record a journal entry for your depreciation calculation.

The company then needs to measure the value of the asset at the end of its useful life. This method of measuring the decreased value of the asset in the useful years is called depreciation. Depreciation is an accounting method companies use to allocate and estimate an asset’s costs over the course of its useful life. Mainly for tax purposes, depreciation accounts for the way in which an asset will degrade over time.

In the case of 200%, the asset will depreciate twice as fast as it would under straight-line depreciation. The carrying value of an asset decreases more quickly in its earlier years under the straight line depreciation compared to the double-declining method. In the last year of an asset’s useful life, we make the asset’s net book value equal to its salvage or residual value. This is to ensure that we do not depreciate an asset below the amount we can recover by selling it.

One way of accelerating the depreciation expense is the double decline depreciation method. Lastly, under this method of depreciation accounting, the value of the asset never gets zero. The method is a little more complicated than the straight-line method.

Since the assets will be used throughout the year, there is no need to reduce the depreciation expense, which is why we use a time factor of 1 in the depreciation schedule . If, for example, an asset is purchased on 1 December and the financial statements are prepared on 31 December, the depreciation expense should only be charged for one month. In this lesson, I explain what this method is, how you can calculate the rate of double-declining depreciation, and the easiest way to calculate the depreciation expense. An asset for a business cost $1,750,000, will have a life of 10 years and the salvage value at the end of 10 years will be $10,000.

Unlike straight-line https://1investing.in/, which dictates that an asset will experience the same amount of depreciation over the course of its lifetime, DDB depreciation will cause the asset to depreciate twice as quickly. Lastly, under this method von depreciation accounting, the value of the asset none gets zero. Straight-line rate of 10%), the depreciation rate of 20% would be charged on its carrying value. Now that we have a beginning value and DDB rate, we can fill up the 2022 depreciation expense column. If the beginning book value is equal with the salvage value, don’t apply the DDB rate. Instead, compute the difference between the beginning book value and salvage value to compute the depreciation expense.

What Is Depreciation? – Seeking Alpha

What Is Depreciation?.

Posted: Sat, 11 Feb 2023 08:00:00 GMT [source]

Deskera has the transaction data consolidate into each ledger chart of accounts example. Their values will automatically flow to respective financial reports. The depreciation expense is entered in contra account of the balance sheet, each year, like equipment, plant, or property.