Videos de Sexo > Bookkeeping > Hourly wage for Bookkeeper

Descricao do video:

Contents:

Flat rate bookkeeping services are becoming more popular because they have the flexibility to provide services at lower prices than other companies that charge hourly rates. The pricing on this may vary based on the complexity of the project, but you can expect it to fall in line with basic hourly rates. This article will dive into outsourced bookkeeping rates, including how much you can expect to pay based on what kinds of services you need and the type of provider you choose to work with. In addition to this, we’ll explore other factors—such as location and the complexity of services—and how they impact pricing, too. Flat-rate pricing, like hourly rate billing, has advantages and disadvantages.

Childminders in the UK must get rates aligned to survive – The Freelance Informer

Childminders in the UK must get rates aligned to survive.

Posted: Thu, 13 Apr 2023 08:27:26 GMT [source]

The average salary for bookkeepers is $40,168, but that normally requires some level of experience to achieve. Furthermore, a good starting salary for a bookkeeper can vary by state. While a bookkeeper can average a salary of $40,337 per year, or $19.39 per hour, there are many opportunities for bookkeepers to make more. For example, in Washington, DC you might make $48,188 per year. Other high-paying locations include New York, NY, Boston, MA and Seattle, WA. If you’re in an entry-level position, your best bet is to move to Washington, DC where the average starting salary is $35,000. The highest paying states for bookkeepers include New York, Massachusetts and Connecticut.

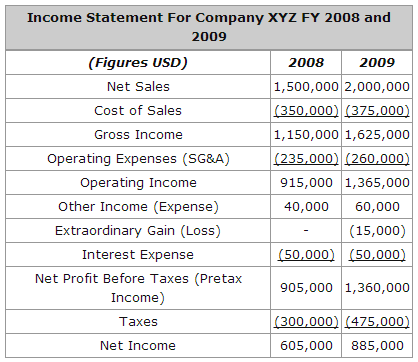

Average Total Hourly Cash Compensation

Just like any other freelancer, freelance bookkeepers work for themselves and provide bookkeeping services for clients. Freelance bookkeepers can be a good option if you understand bookkeeping in depth, and are able to be the second set of eyes for your books. When selecting a freelancer, it is important to review their work history and any certifications, degrees, or credentials they have when it comes to bookkeeping. However, freelancers with these types of credentials are often more expensive.

Meanwhile, Arkansas, Nebraska, and West Virginia offer the lowest salaries. I talk about hourly rates because even if you are charging a fixed fee, it will usually be rooted on an hourly rate. And in my opinion, you still need to measure how much time it takes so you can check that the job is profitable – especially if you have staff or team that you’re paying to do the work. For now, for the purposes of this blog, I’ll just say that I’m not wedded to fixed fees or hourly rates. I think that both can work and sometimes one suits one client or one bookkeeper, and the other suits another type of client or another type of bookkeeping business.

School board hires four new staff members – Rapid City Journal

School board hires four new staff members.

Posted: Wed, 12 Apr 2023 07:00:00 GMT [source]

On the plus side, if a task goes longer than expected, you will be compensated for all hours done. In terms of disadvantages, the only method to boost hourly wage is to work longer hours or raise your hourly rate. Consider enlisting the help of financial marketing professionals Solutions for CPA Sites to create a unique website for your company. The average bookkeeper salary is $48,079 in New York, $47,205 in Massachusetts, and $46,977 in Connecticut. These are the three highest-paying states for bookkeepers in the US.

wave accounting salaries in Spain range from 720 EUR per month to 2,220 EUR per month . This is not the minimum wage as per the law, only the lowest reported number in the salary survey that had thousands of participants and professionals from all over the country. A QuickBooks bookkeeper is a person who keeps track of all the financial transactions that happen in a company. They are also responsible for reconciling the books and making sure that all the transactions have been recorded correctly.

Part Time Bookkeeper

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Fit Small Business content and reviews are editorially independent. We may make money when you click on links to our partners. Compensation data tools, salary structures, surveys and benchmarks.

You’ve also kept track of hours spent per customer or project using a time and billing system like FreshBooks throughout this time. Because you have a solid record of how long it takes you to finish client work, calculating a flat charge based on the sort of work you do for each customer will be simple. When determining what to charge for accounting services, you should also consider the amount of time you will give services to a customer. Some consumers may be one-time customers, while others will need services on a monthly, quarterly, or yearly basis. If you’re a new freelancer, you’ll have to stick to the status quo and charge your customers by the hour. This will assist you in keeping things simple when you choose what services you want to provide your clientele.

- Price for bookkeeping services can vary from state to state.

- I know there’s a lot of talk about fixed fees and value-based pricing these days (fixed fees and value-based pricing are different and I’ll write more about that someday).

- Many bookkeepers charge their clients for initial consultations because it gives them a chance to look at the books.

- Generally, you’ll charge a lower rate for clients you see more often.

- We all know that cheaper is usually not better and that is why brands like Gucci, Armani, and Chanel can charge such high prices and have people more than willing to pay.

Any of the above types of bookkeepers can be a virtual bookkeeper—those bookkeepers who interact with their clients and do all their work virtually or remotely. So if you’re looking for the answer to “how much do virtual bookkeepers charge? This is the same in countries outside the United States, too. Let’s imagine you give remote help to your QuickBooks customers and in one month, you generated $600 in revenue from six troubleshooting sessions.

Type of Bookkeeper

Offering payroll and tax preparation services in addition to accounting services might help you improve your billable rate if you have the necessary skills. These charts show the average hourly wage , as well as the average total hourly cash compensation for the job of Bookkeeper in the United States. The average hourly rate for Bookkeeper ranges from $18 to $23 with the average hourly pay of $21.

Another important factor is your expertise in various accounting software. In general, good cloud-based software makes accounting easier and reduces the hours, allowing you to charge more per hour. Eight key factors will impact the hourly rate you’ll charge for your services. When running a business, it’s important to understand the value that each customer brings to your company. This value is commonly known as Lifetime Value or LTV, which is the amount of revenue a customer generates… These average bookkeeper salary numbers should be considered only base pay.

The remaining 45 states and the District of Columbia have a collective hourly wage of $18.47, with rates ranging from $16.62 to $21.14 per hour. The six major elements that influence how much you may charge for accounting services are listed below. According to our most recent salary estimates, NTT Data International L.L.C. And Latin American Montessori Bilingual Public Charter School are the highest paying companies for bookkeepers.

Certification

The CPA rate for bookkeeping varies from company to company depending on the type of work they need done and the complexity of their system. Job DescriptionPosting supplier invoices, processing payments and issuing sales invoicesBank and expense reconciliation on Xero accounts systemProvide adhoc analysis and share with.. Posting supplier invoices, processing payments and issuing sales invoices.

This information may be transferred to an estimate or quotation, which you can then present to your prospective new customer for approval. Your services go beyond the books to provide real value to your clients. Your customer may anticipate a lower tax bill as a consequence of correct records, save fines and interest, and have confidence that they will pass an audit since they will be in compliance due to you. The The American Institute of Professional Bookkeepers is an association of professional bookkeepers in the United States. Thousands of bookkeepers have finished one or more of these programs (including self-study), boosting their earning potential and putting their resumes ahead of the competition. NTT Data International L.L.C. Has the highest average salary for bookkeepers.

For a client who’s revenue starts at $300k and goes up, she will insert a base of $400 and then add on any extra services they may need. Starting with an hourly rate with a new client is beneficial because usually it will take more time to get their books set up, as they could have been quite a mess before you took them on. You may be helping them play catch-up to get organized not only in the current year, but also in previous years. It will be more work upfront, so you can bill more upfront.

How much should I charge for bookkeeping services? 6 Factors to consider

As a self-employed bookkeeper, you are likely providing these things yourself. In my mind, I was thinking that by having a lower price my services would be more desirable, but here I was being presented with an alternative perspective and it was quite an eye-opener. Some of these things have obvious connections to my bookkeeping pathway but every single other thing brought a breadth of experience that has come in handy in my bookkeeping career.

- Exceptions do exist, but generally speaking, the situation of any company is closely related to the economic situation in the country or region.

- Lastly, employees with more than twenty years of professional experience get a salary of 2,100 EUR per month, 7% more than people with fifteen to twenty years of experience.

- For example, if you need a bookkeeper for an hour, it could cost $30.

- If you’re a new freelancer, you’ll have to stick to the status quo and charge your customers by the hour.

- The total hourly cash compensation, which includes base and short-term incentives, can vary anywhere from $19 to $23 with the average total hourly cash compensation of $21.

For one-time clients, you may decide to charge more since you know they may not return and have last-minute requests and needs. Partnering with Patriot earned this accountant a 50% cost savings from his previous provider, decreased his time running payroll, and more! Chances are, clients are going to be more willing to pay an accounting firm more money over another if they have more experience. When setting your bookkeeping services prices, consider creating different tiers for the size of the client.

Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years. She holds a Bachelor’s degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about travel, food, and books for various lifestyle publications.

Compare salaries for individual cities or states with the national average. Location, education, and experience impacts how much a bookkeeper can expect to make. Bookkeepers make the most in New York, Massachusetts, Connecticut, New Jersey, and Alaska. Whatever structure and pricing you go with, make sure to lay it all out on the table for current and prospective clients. That way, there are no surprise fees, and clients know what to expect from you. Unlock the potential in your business so that you can move from overwhelmed bookkeeper, feeling stuck and not sure what to do next, to thriving bookkeeping business owner living your best business life.

So any bookkeeper charging low rates is bringing all of us down and makes it harder for the next person to charge what they’re worth. For example, a client with about $500k in revenue, she would charge $650 a month as a bookkeeper. This would be for the basic bookkeeping, reconciling, and bank accounts. Bobby Hoyt is a former band director who paid off $40,000 of student loan debt in 18 months on his teaching salary and then left his job to run Millennial Money Man full-time. He helps other Millennials earn more through side hustles, save more through budgeting tools and apps, and pay off debt. Hourly wages for in-house bookkeepers range from $16.55 to $26.85, depending on the geographic location.